JIB ››

This prints the Operating Statements for Investors. It's a good idea to print the Preliminary Reports and verify that all entries have been made to each unit for the period, prior to printing Operating Statements. If these reports don't look accurate, you should make the necessary corrections before printing Operating Statements.

Disbursing Revenue and Billing Investors is an inherently complex process because of all the different methods Operators like to use, such as Netouts, Minimum Check Amounts, etc... Sorry about that. However, the good news is the system does a LOT of self checking prior to printing and if you verify the Preliminary Reports you should do just fine.

TUTORIAL SCENARIO

Print this for Company Number 01 and use dates that will apply to the dates you entered for your transactions. Refer to the Notes on Fields if you need more info.

PRINT OPERATING STATEMENTS

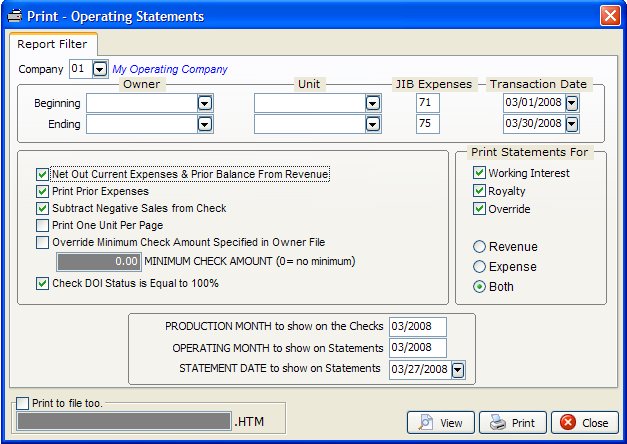

Select JIB - Operating Statements, and the Filter appears as follows:

After you select Print, the system performs an automatic internal Sanity Check of your data files, before it prints. If it finds any errors, it prints a list of the errors and action to take to correct.

Operating Statements should show that:

All Owners listed in the DOI file with expense percentages for each Unit were billed their respective share of the gross expenses.

All owners listed in the DOI file with revenue and tax percentages received their share of the run check.

The Owner percentages used were those in the DOI file for expenses, revenue and taxes that correspond with the status of the transaction.

NOTES ON FIELDS

COMPANY NUMBER: Do one company at a time. Print statements, checks and update Operating Statements for one company at a time.

OWNER NUMBER: Leave blank for beginning and ending owners numbers to have statements print for all owners and all owner types W/R/O (Working Interest, Royalty and Override). However, you can specify a beginning and ending owner number to print selectively. These filters are usually only used when you need to re-print only a certain segment of the statements due to your printer messing up.

UNIT NUMBER: Leave blank for beginning and ending unit numbers to have statements print for all units. These filters are used just like the owner numbers above.

JIB EXPENSES: Leave the default for both beginning and ending filters for the group of JIB and revenue expenses to print. This filter refers to the GL numbers of billable expenses. The billable expenses are GL numbers 71000 to 75999. GL Number Restrictions You could use this filter to prevent all groups of expenses from appearing on the statements. Remember the category descriptions for the groups can be changed by using the Tool for Heading Descriptions or editing the Company Chart of Accounts.

BEGINNING AND ENDING TRANSACTION DATES: Normally this is the beginning and ending date of your period (or month). Only transactions within the specified range are processed.

NETOUT CURRENT EXPENSES & PRIOR BALANCE FROM REVENUE: Leave it checked.

This is the priority level for all other filters. Netout means to subtract current expenses and prior balances in Accounts Receivable from the current revenue in accordance with how the owner is set up in the Owner file and in the DOI file. See How to Use NetOut's for more info.

If not checked for netout, no netout will be saved regardless of the coding in the Owner and DOI file. When Owners have current revenue and expenses, owners will receive a check for revenue and owe you for expenses. Any prior balance due will reflect "not netted" on the Operating Statement automatically. Any prior balances not netted for this owner will be added to the “Total Amount You Owe” in the Summary of all Units section of the Operating Statements.

PRINT PRIOR BALANCES: Normally, check marked to print prior balances on the Operating Statement. If you do not netout and list prior balances, the summary prints “PRIOR BALANCES DUE (NOT NETTED)”.

SUBTRACT NEGATIVE SALES FROM CHECK: Normally, check marked. This feature will combine negative revenue with positive revenue for the check amount. If you do not netout and do not put a check mark for this field, the owner is billed for his share of the negative revenue just like he is billed for expenses. An Accounts Receivable invoice will be generated for negative sales. He would receive a check for any positive sales.

PRINT ONE UNIT PER PAGE: Prints one unit per Operating Statement page. This uses more paper.

OVERRIDE SPECIFIED MINIMUM CHECK AMOUNT DESIGNATED IN OWNER FILE:

To override the minimum check amount specified in the Owner/Customer file, the filter must be check marked and then enter a minimum check amount. (zero=no minimum). The amount you enter will override the specified amount in the Owner file to process Operating Statements.

All minimum check amounts, regardless of how small the amount, should be released in the December revenue checks to coincide with owner’s Government Form 1099 information for the Calendar Year. Normally you will override the minimum check amount in the Owner/Customer file and enter zero (0) for minimum check amount in Operating Statement filter. Minimum check amount will be released for all owners & all units specified in the filter. Minimum check amount does not apply to printing Expense Only statements. You do not need transactions in the Transaction file to release minimum check withhold balances. Specify either Revenue or Both (not just Expenses) in Operating filter to release withheld balances. See How to Use Minimum Check Amounts for more info.

CHECK DOI STATUS LEVELS: This checks to make sure every Division of Interest status level totals to 100%.

PRINT WORKING INTEREST, ROYALTY OR OVERRIDE OWNERS:

Select for working interest owners, royalty owners, override owners or any combination to print. Leave the space blank to print for all owners. The beginning and ending owner numbers will be checked based on the type of owner you specified. Owners are assigned as W, R or O in Division of Interest File .

REVENUE only, EXPENSES only, BOTH: Operating Statements can combine both revenue and expenses into a single statement, saving a lot of paper. However, you can print individually if you prefer. Printing expenses only will generate Operating Statements for the amount you owe and minimum withheld balance is not released. Revenue only will generate revenue statements for total amount you receive plus year to date minimum withheld or life to date suspense release balance.

PRODUCTION MONTH TO SHOW ON CHECKS: This month is printed on the checks, and refers to the month in which the revenue was collected. If you have multiple production periods, you would indicate the oldest production month to appear on the revenue check stub. Usually the period for the transactions is different than the production month and operating month, and using this field avoids any conflicts.

OPERATING MONTH TO SHOW ON STATEMENTS: This month is printed on the statements, and refers to the month in which the expenses were incurred. Used as part of JIB invoice number assigned in Accounts Receivable programs.

STATEMENT DATE: Date to be printed on statements.

VIEW, PRINT OR FILE: If you select print to file, enter the file name for report. An example would be OPRJUN.HTM. The name should be representative of the report. OPRJUN would be Operating Statements for June. The file name should not be more than 8 letters to conform with some operating systems. Do not use spaces, symbols or characters in the file name. The period (.) and extension name of .HTM will be added to the file name. The file will be written to your current data directory. To print the file at a future date, select Tools - Print Saved Reports.

When you ‘View’ the statements you will be able to preview 25 pages at a time.

Created with the Personal Edition of HelpNDoc: Easy CHM and documentation editor